Last month, something remarkable happened in the crypto world. The derivatives trading market exceeded $1.33 trillion in monthly trading volume. Let that sink in. Over a trillion dollars moving through platforms that let traders profit from cryptocurrency price movements without actually owning the coins.

This isn’t a niche market anymore. Major platforms like Kraken and Coinbase have launched derivatives exchanges in the United States. Institutional investors and everyday traders are flocking to these platforms for advanced trading tools, leverage options, and risk management features.

If you’re thinking about entering the crypto exchange business, derivatives trading represents one of the most profitable opportunities available today. The technology is proven. The demand is real. The question is whether you’re ready to build your platform and capture a share of this massive market.

Let me walk you through everything you need to know about crypto derivatives exchange development, from understanding what derivatives are to launching your fully functional platform.

What are Crypto Derivatives?

Before building a derivatives exchange, you need to understand what crypto derivatives actually are.

Crypto derivatives are financial contracts that get their value from underlying cryptocurrencies like Bitcoin or Ethereum. Here’s the key part: traders don’t need to own the actual cryptocurrency. Instead, they trade contracts based on where they think prices are heading.

Think of it like this. Instead of buying a house, you make a bet on whether housing prices will go up or down. If you’re right, you profit. If you’re wrong, you lose money. The same concept applies to crypto derivatives, except the underlying asset is Bitcoin, Ethereum, or another digital currency.

There are three main types of crypto derivatives:

Futures contracts are agreements to buy or sell cryptocurrency at a specific price on a future date. For example, you might agree today to buy one Bitcoin at $50,000 three months from now. If Bitcoin’s price is $60,000 when the contract expires, you made a good deal. If it drops to $40,000, you overpaid.

Options contracts give traders the right, but not the obligation, to buy or sell crypto at a predetermined price by a certain date. This flexibility makes options popular for risk management. You can protect yourself from price drops without being forced to complete a trade if conditions change.

Perpetual contracts are similar to futures but never expire. Traders can hold positions as long as they want, paying or receiving funding rates based on market conditions. These have become extremely popular because they offer leverage and don’t require managing expiration dates.

The beauty of derivatives is they let traders profit whether prices go up or down. In a bull market, you go long (bet on rising prices). In a bear market, you go short (bet on falling prices). This flexibility attracts professional traders who want more sophisticated tools than simple buying and selling.

What is a Crypto Derivatives Exchange?

Now that you understand derivatives, let’s talk about the platform that makes trading them possible.

A crypto derivatives exchange is a specialized trading platform where users can buy, sell, and trade derivative contracts. Unlike regular cryptocurrency exchanges where you purchase actual Bitcoin or Ethereum, derivatives exchanges only deal in contracts.

Here’s how it works in practice. A trader creates an account, completes identity verification, deposits funds (usually stablecoins like USDT or USDC), and then opens positions on various derivative contracts. The exchange matches buyers with sellers, manages margin requirements, handles liquidations when positions lose too much value, and processes settlements when contracts expire or close.

The exchange makes money primarily through trading fees (a small percentage of each trade), funding rates on perpetual contracts, liquidation fees when traders’ positions get forcibly closed, and withdrawal fees when users move funds off the platform.

The key difference between a derivatives exchange and a traditional crypto exchange is what’s being traded. A traditional exchange lets you buy actual Bitcoin that you can withdraw to your wallet. A derivatives exchange only offers contracts that represent Bitcoin’s price. You can’t withdraw Bitcoin from a derivatives trade, only the profit or loss from your position.

Key Features of a Crypto Derivative Exchange

Building a successful derivatives exchange requires implementing features that professional traders expect and demand. Miss any of these, and users will choose competitors instead.

High-performance trading engine is the heart of your exchange. It processes incoming orders, matches buyers with sellers, updates order books in real-time, and handles thousands of transactions per second. Speed matters enormously here. Even milliseconds of delay can cost traders money and send them to faster platforms.

Advanced order types give traders flexibility in how they execute strategies. Market orders execute immediately at current prices. Limit orders only execute at specific prices or better. Stop-loss orders automatically close positions to limit losses. Take-profit orders lock in gains when targets are hit. Conditional orders trigger based on multiple criteria.

Margin and leverage system lets traders control larger positions with less capital. If a platform offers 10x leverage, a trader can control $10,000 worth of contracts with only $1,000 in margin. This amplifies both potential profits and potential losses. Your exchange needs systems to calculate margin requirements, monitor positions continuously, and automatically liquidate positions that fall below maintenance margins.

Risk management tools protect both traders and the exchange. Position limits prevent users from taking excessive risk. Liquidation engines close losing positions before they go negative. Insurance funds cover losses when liquidations don’t execute in time. Auto-deleveraging systems share losses among profitable traders in extreme situations.

Multi-asset support allows trading derivatives for Bitcoin, Ethereum, and other major cryptocurrencies. The more trading pairs you offer, the more users you attract. But each new pair requires liquidity, so start with the most popular assets and expand gradually.

Real-time analytics and charting help traders make informed decisions. Display price charts with multiple timeframes, technical indicators like moving averages and RSI, order book depth showing buy and sell pressure, trading volume and open interest data, and funding rate history for perpetual contracts.

Secure wallet integration manages user deposits, withdrawals, and cold storage for most funds. Only keep enough in hot wallets to handle daily trading needs. The rest should be in multi-signature cold storage that requires multiple approvals to access.

KYC and AML compliance verifies user identities and monitors suspicious activity. Regulations vary by jurisdiction, but most require identity verification, proof of address, and ongoing transaction monitoring to prevent money laundering and fraud.

Mobile application is essential because many traders monitor and manage positions from their phones. Your mobile app should offer all critical features: opening and closing positions, setting stop-losses and take-profits, real-time price alerts, and quick deposits and withdrawals.

Cost of Cryptocurrency Derivatives Exchange Development

One of the first questions entrepreneurs ask is how much building a derivatives exchange actually costs. The honest answer is it depends on several factors, but let me break down the typical cost ranges.

Building from scratch using custom cryptocurrency exchange development services typically costs between $150,000 and $500,000 or more. This approach gives you complete control over features, design, and functionality. You build exactly what you want with no limitations. However, development takes 6 to 12 months, requires ongoing maintenance, and needs expensive blockchain developers and security experts.

Using white-label cryptocurrency exchange software dramatically reduces both time and cost. White-label solutions typically cost $50,000 to $150,000 and can launch in 2 to 4 months. You get pre-built core features, proven security infrastructure, and ongoing support from the software provider. The tradeoff is less customization and dependence on the vendor for updates and maintenance.

Beyond initial development, factor in ongoing operational costs including server hosting and infrastructure ($2,000 to $10,000 monthly depending on trading volume), security audits and penetration testing ($15,000 to $50,000 per audit, recommended quarterly), compliance and legal fees ($10,000 to $100,000+ annually depending on jurisdictions), customer support staff, marketing and user acquisition, and liquidity provision through market makers.

The scope of features dramatically impacts cost. A basic platform supporting only Bitcoin and Ethereum futures might cost $80,000. Add options trading, perpetual contracts, advanced order types, copy trading, staking features, and multi-chain support, and costs easily exceed $300,000.

Your choice between building from scratch or using white-label software is the biggest cost driver. For most entrepreneurs, starting with a white-label solution makes the most sense. Launch faster, prove the business model, then invest in custom development once you have users and revenue.

Steps in the Derivatives Exchange Development Process

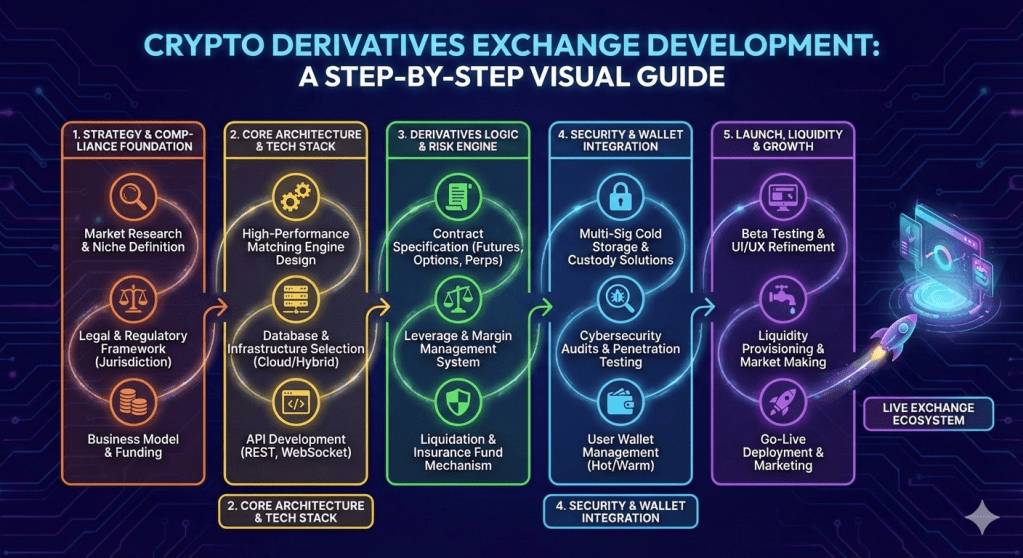

Building a derivatives exchange follows a structured process. Skip steps or rush through them, and you’ll face serious problems after launch. Here’s how professional development actually works.

Step 1: Planning and Market Research

Every successful exchange starts with thorough planning. Analyze the current derivatives market to understand what platforms exist, what features they offer, where gaps exist, and who your target customers are.

Define your unique value proposition. Will you offer the lowest fees? The fastest execution? The best user interface? Support for niche cryptocurrencies? Focus on specific regions? You need a clear answer to why traders should choose your platform over established competitors.

Create a detailed roadmap outlining development phases, feature priorities, budget allocation, timeline to launch, and long-term vision for growth. This roadmap guides your entire development process and helps investors understand your plan.

Consult with legal experts familiar with cryptocurrency regulations. Understand what licenses you need, what jurisdictions you can operate in, and what compliance requirements apply to your business. Getting legal wrong can shut down your exchange before it even launches.

Step 2: Choose Your Technology Stack

Your technology choices affect performance, security, scalability, and development costs. Select carefully based on your specific needs.

For the blockchain layer, decide whether you’ll operate on Ethereum, Binance Smart Chain, Solana, or multiple chains. Most derivatives exchanges start on one blockchain and expand later. Ethereum has the largest ecosystem but higher fees. Solana offers incredible speed but less decentralization. Binance Smart Chain balances both reasonably well.

Choose backend programming languages and frameworks that support high-performance trading. Popular options include Go, Rust, or C++ for the trading engine (speed is critical here), Node.js or Python for API services, PostgreSQL or MongoDB for databases, and Redis for caching and real-time data.

Select frontend technologies that create smooth user experiences including React or Vue.js for web applications, React Native or Flutter for mobile apps, and WebSocket connections for real-time price updates.

Step 3: Design User Experience

Design interfaces that serve both beginners and professional traders. Your platform needs to feel intuitive while providing powerful tools.

Create clean, organized layouts with clear navigation. Essential information like current positions, available margin, and open orders should be immediately visible. Charts and order books need to be large and readable. Mobile designs require different layouts optimized for smaller screens.

Implement features that reduce user errors including confirmation dialogs for large trades, clear warnings about liquidation risks, easy-to-understand profit and loss displays, and simple position management tools.

Test designs with actual traders before finalizing. What makes sense to developers often confuses real users. Get feedback early and iterate based on what people actually need.

Step 4: Develop Core Platform

This is where your exchange comes to life. Development typically happens in phases, with core features built first and advanced features added later.

Build the trading engine capable of processing thousands of orders per second, matching buyers and sellers efficiently, updating order books in real-time, and handling various order types accurately. This is the most critical component. A slow or buggy trading engine ruins the entire platform.

Develop the margin system that calculates required margin for positions, monitors account balances continuously, triggers margin calls when balances fall too low, and executes automatic liquidations to protect the exchange.

Create the settlement system that handles contract expirations for futures, calculates profit and loss accurately, processes funding rate payments for perpetuals, and manages deposits and withdrawals securely.

Implement user management including registration and KYC verification, secure authentication with two-factor options, account settings and preferences, and transaction history and reporting.

Step 5: Integrate Security Measures

Security cannot be an afterthought. Build it into every layer of your exchange from day one.

Implement encryption for all sensitive data in transit and at rest. Use industry-standard protocols like TLS 1.3 for connections and AES-256 for stored data.

Set up multi-signature wallets for cold storage requiring multiple authorized parties to approve withdrawals. Most user funds should always be in cold storage, with only operational amounts in hot wallets.

Add DDoS protection to prevent attacks from overwhelming your servers. Use services like Cloudflare or AWS Shield to absorb attack traffic.

Implement rate limiting to prevent API abuse and suspicious trading activity. Monitor for unusual patterns that might indicate account compromises or manipulation attempts.

Conduct regular security audits by professional firms. Budget for at least two comprehensive audits before launch, then quarterly audits after going live. One missed vulnerability can drain your entire exchange.

Step 6: Testing and Quality Assurance

Never launch without extensive testing. The cost of fixing bugs in production is exponentially higher than catching them during testing.

Run functional testing to verify every feature works as designed. Does the trading engine match orders correctly? Do liquidations trigger at proper thresholds? Can users deposit and withdraw without issues?

Conduct performance testing under high load. Simulate thousands of concurrent users and orders per second. Identify bottlenecks and optimize before they affect real traders.

Perform security testing including penetration tests by ethical hackers, vulnerability scans of all systems, and smart contract audits if using blockchain settlement.

Run user acceptance testing with real traders. Give them access to testnet versions and watch how they use the platform. Their feedback reveals usability issues you never anticipated.

Step 7: Launch and Ongoing Maintenance

After testing, you’re ready to launch. But launching is just the beginning of your journey.

Start with a soft launch to limited users. Invite early adopters and monitor system performance closely. Be ready to fix issues quickly based on real-world usage.

Implement comprehensive monitoring of server performance, database queries, trading engine latency, wallet balances, and user activity patterns. Set up alerts that notify you immediately when problems occur.

Provide excellent customer support from day one. Responsive support builds trust and loyalty. Slow or unhelpful support drives users to competitors.

Plan regular updates adding new features, improving performance, fixing bugs, and responding to user feedback. Successful exchanges continuously evolve based on what traders want.

Build and Launch Your Derivatives Exchange Securely With Suffescom

Building a crypto derivatives exchange is complex and requires specialized expertise across blockchain development, financial systems, security, and regulatory compliance. While it’s possible to assemble an in-house team, most entrepreneurs find that working with an experienced development partner accelerates time to market and reduces risk.

Suffescom Solutions offers comprehensive Crypto Derivatives Exchange Development services that handle every aspect of building and launching your platform. With years of experience in blockchain and financial technology, their team understands the unique challenges of derivatives trading platforms.

Whether you need a fully custom solution built from the ground up or prefer a white-label platform you can brand and launch quickly, Suffescom provides options that fit your budget and timeline. Their development process includes thorough planning and market analysis, secure and scalable architecture design, feature-rich platform development, comprehensive security implementation, regulatory compliance guidance, and ongoing support and maintenance.

The crypto derivatives market is growing rapidly, with billions in daily trading volume and increasing institutional adoption. The opportunity is real and substantial. The question isn’t whether to enter this market, but how quickly you can launch a competitive platform.

With the right development partner, clear vision, and commitment to security and user experience, you can build a derivatives exchange that attracts traders and generates significant revenue. The technology exists. The market is ready. Your platform could be next.

Leave a reply to William Taylor Cancel reply